does instacart take out taxes for shoppers

What Taxes Do Instacart Shoppers Need to Pay. Fees vary for one-hour deliveries club store deliveries and deliveries under 35.

Gonzalez Slams Instacart For Tax Credit Program Withdraw San Diego News Desk

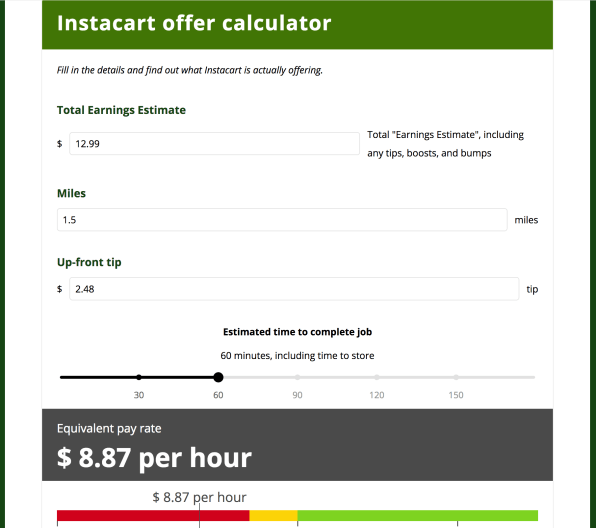

Accurate time-based compensation for Instacart drivers is difficult to anticipate.

. As of December 2020 159 shoppers reported a range of earnings from 7 to 21 per hour. It depends on what state you live in but on average youll be paying 20-25 of income earningstips. Knowing how much to pay is just the first step.

Instacart Shoppers weve put. If you dont have direct deposit set up they will mail you a check. According to Glassdoor in-store Instacart shoppers earn an average of 13 per hour.

When are your taxes due. This includes self-employment taxes and income taxes. Download the Instacart app or start shopping online now with Instacart to get.

If you choose to become an in-store shopper youll know ahead of time how much you can expect to make when you pick up a shift. Instacart Shoppers Qualify for a Forgivable loan. The organization distributes no official information on temporary worker pay however they do.

Only Customers shopping in Oklahoma with a 100 disabled veteran sales tax exemption card issued by the Oklahoma Tax Commission can contact Instacart Care to request a sales. Then complete the contact form and we will instantly email you a quote. Does Instacart Take Out Taxes For All Employees.

To file your taxes just click on Book Tax Appointment. This is a loan you do not pay back. In-Store Shopper Hourly Earnings.

Instacart shoppers are required to file a tax return and pay taxes if they make over 400 in a year. To actually file your Instacart taxes youll need the right tax form. In 2022 you can deduct a fixed amount of 585 cents per mile while the rate for 2021 was 56 cents per mile.

Start Instacart Tax Return. Find out the top deductions for Shoppers and more tax tips here. Yes even as an independent contractor you are to report your earnings from working as an independent contractor at a 3rd party delivery driver Instacart UberEats.

These rates include all your vehicles operational expenditures such as. Instacart pays shoppers weekly on Wednesday via direct. For its part-time shoppers Instacart doesnt take out taxes and they file W-2s.

The Instacart 1099 tax forms youll need to file. To make saving for taxes easier consider. Instacart delivery starts at 399 for same-day orders over 35.

Because Instacart shoppers are contractors the company will not take taxes out of your paycheck. Unfortunately this means you need to pay quite a lot of self employment. Answer 1 of 4.

Up to 10 cash back Order same-day delivery or pickup from more than 300 retailers and grocers. Instacart pays shoppers weekly on Wednesday via direct deposit for the previous Monday through Sunday week. Since in-store shoppers are traditional part-time employees Instacart handles withholding money for taxes.

Does Instacart Take out Taxes. When people tip Instacart the Shoppers keep 100 of the tips they earn. Instacart shoppers typically file personal tax returns by April 15th for the income you earned from January 1st to December 31st the prior year.

Get the scoop on everything you need to know to make tax season a breeze. Since in-store shoppers are traditional part-time employees Instacart handles withholding money for taxes. Remember working as contractor for instacart or uber etc you are self employed sort of running a small business.

What Taxes Do Instacart Shoppers Need to Pay. Its the same taxes youd be paying in an employee. But Instacart pays its in-store shoppers a base pay of 10 per hour plus commission through the.

There will be a clear indication.

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

What You Need To Know About Instacart Taxes Net Pay Advance

Instacart Taxes The Complete Guide For Shoppers Ridester Com

The Ultimate Tax Guide For Instacart Shoppers Stride Blog

What It S Really Like To Be An Instacart Shopper Bon Appetit

How To Make 100 Or More A Day Doing Something You Do Every Week

What It S Really Like To Be An Instacart Shopper Bon Appetit

What You Need To Know About Instacart 1099 Taxes

Does Instacart Track Mileage The Ultimate Guide For Shoppers

Filing Your Taxes As An Instacart Shopper Tax Tips For Independent Contractors Youtube

How To Get Instacart Tax 1099 Forms Youtube

10 Items Or Less Do Your Best For Your Customers

Instacart Taxes How Taxes Work For Instacart Shoppers 1099 Cafe

How To File Your Taxes As An Instacart Shopper Contact Free Taxes

Is Instacart Worth It Ultimate 2022 Guide How Much Can You Make

Be An Instacart Shopper Instacart Shopper Pay And Instacart Driver Info

Instacart Taxes The Ultimate Tax Guide For Instacart Shoppers Ageras

How Much Does Instacart Pay Shoppers Delivery Groceries In 2022

Instacart Drivers Say This Data Proves They Re Still Being Underpaid